Why Do Property Investors Network At Live Events In Manchester, But Don't Learn How To Get Started With Little Or No Money Down?

With half the room being first-time attendees, they discover that their education can be costly and the property strategies being taught require savings, borrowing and a decent credit rating...meaning they never return!

What's Happening In The Manchester Market Today

Manchester brings investors from all parts of the UK. Prices here are generally lower, even 50% or less than the median prices of London. This makes investing more accessible, with all the same attributes of a big city — but that doesn’t mean the steps are any easier. Additionally, its growing tech and student sectors attract both first-time and seasoned investors

Some things to expect:

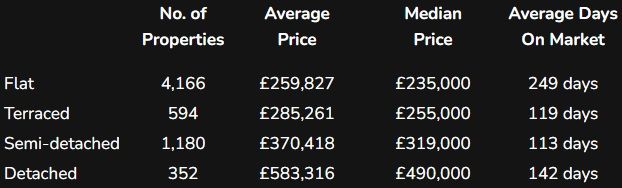

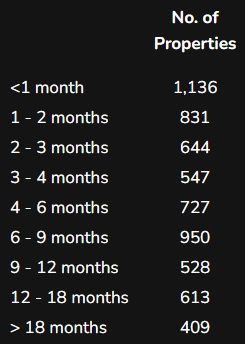

Competition for properties: Reviewing the chart and data above, the biggest cluster of sales activity falls between £100,000 and £400,000, but with average sales days similar to London — possibly due to the aggregation of sales chains from a large population. Noticeably, these three relevant bands between them make up 81.5% of all sales!

Upfront costs are still significant: Even with a 15% discount (£37,500) on a £250,000 property (purchase price £212,500), the upfront cash deposit, Stamp Duty Land Tax (SDLT) and fees will be over £50,000 (see summary below).

Additional challenges for non-local investors: To achieve such a discount, often you will need to calculate for any repairs to bring the property up to value, or improvements to increase its value above what you paid. Without a local presence, you may end up spending more than others who hire locally or have teams in place.

Tenant management: Shared accommodations or Houses in Multiple Occupation (HMOs) can create more “people problems”, particularly if you’re managing from a distance.

Summary

Market Value: £250,000

Less Discount: £37,500

Purchase Price: £212,500

Cost of Savings:

£53,125 (Your Savings / Existing Equity) + £12,375 (Stamp Duty Land Tax)

Total Cost: £65,500 *

* While yields can be strong, the initial outlay remains a hurdle for many.

Still, it’s worth attending a local investors’ event to see firsthand what options are being discussed. Try searching “property investor meetings manchester” on Google to find venues nearby. When you go, ask this one key question: “How can you realistically get started with little or no money?” You’ll likely hear that the only option is deal sourcing — finding properties for others in exchange for a commission. But that’s not a long-term investment strategy.

There are alternative methods that don’t require large savings, and some of them were once popular across the UK after the 2008 financial crisis — and still work today. My colleague and I have adapted and taught these approaches for over 20 years, and we’ve put them together in a free multimedia resource. It explores practical ways to start investing with minimal upfront cash. While you don’t need to study it before attending an event, knowing these approaches will help you ask better questions and see the bigger picture.

So far, we’ve touched on what makes up roughly 95% of the conversations you’ll hear at property investor network meetings across Manchester in 2025. Attendees and presenters often discuss creative models like purchase lease options, but most are still tied to some form of borrowing — bridging loans, mortgages, or investor funding. In other words, most “creative” strategies still rely on having access to cash or credit before you even begin.

From the above chart and data, it’s clear that not every seller is motivated, and not every home fits neatly into a profitable strategy. The reality is that even in a vibrant city like Manchester, many deals fall through because they simply don’t stack up when finance, refurbishment, or resale timelines are factored in.

For those starting without significant savings — perhaps stuck in a 9-to-5 routine or unsure where to begin — this can be disheartening. It’s one reason many newcomers attend a property networking event once, realise the financial barriers, and never return. Others spend thousands on mentorships or “mastermind” programmes (£10K–£25K per year) hoping for shortcuts, only to find that the basics still require capital and credit.

After 25 years of developing and refining creative property strategies in the UK, I’ve seen the same cycles repeat. Each time lending tightens — as it is again now — investors feel the squeeze: higher deposits, stricter lending criteria, and more regulation. But these market conditions also highlight why alternative strategies matter.

Understanding the above points will help you attend your first Manchester networking event better prepared — with realistic expectations. Yet it’s also important to remember that opportunity hasn’t disappeared; it’s simply changed shape. Some of the most effective strategies today are hiding in plain sight.

One particular approach allows investors to get started with minimal upfront capital and almost no competition:

✅ No mortgage required

✅ No mortgage applications

✅ No savings, home equity, or borrowings needed

✅ No stamp duty payable

This was one of the UK’s most practical post-2008 investment methods — and it still works today. But when mentioned at events, many people nod politely and then return to the more familiar, expensive path.

If you’re going to put time into learning and attending your local network meetings, it’s worth exploring alternatives that reduce both financial and learning barriers. The method described above is covered step-by-step in a free multimedia series — including videos, audio, and PDF chapters based on a former #1 real estate book, and now going under the title of, “How to Control a House for a $1 Deposit and No Mortgage Needed”.

It’s designed for those who want to understand property control and creative deal structures from home — even if you’re short on capital or just starting your journey.

Other Locations