Why Do Property Investors Network At Live Events In London, But Don't Learn How To Get Started With Little Or No Money Down?

With around 50% of all attendees being newbies, they discover that their education can be costly and the property strategies being taught require savings, borrowing and a decent credit rating...meaning they never return!

What's Happening In The London Market Today

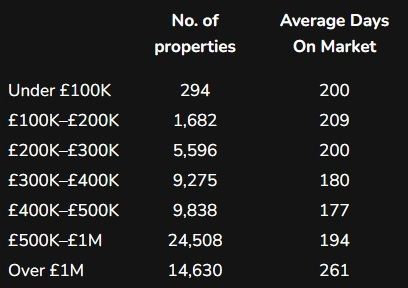

A common consensus among the property investor community is that London is not viable for many strategies due to the exorbitant costs compared to the country north of the M25. Just look at the above sales breakdown in which the highest volume of properties resides in the £500K-£1M bracket.

On one side you have a high margin of profit built in with any purchase with a below market value discount of 10-20%. Let's say you get a 15% discount on a £700,000, bringing down to £595,000. That's a saving of £105,000! However, this "bargain" comes at a cost courtesy of your lender and the government. As an investor buying at least your second property (investment purposes), your lender will have you pay up the first 25% of the purchase price out of your pocket, namely £148,750, and the government wants you to pay them £49,500 in Land Tax Stamp Duty.

Summary

Savings: £105,000

Cost of Savings:

£148,750 (Your Savings / Existing Equity) + £49,500 (Stamp Duty Land Tax)

Total Cost: £198,250

And all of the above may be before you adopt a strategy that has you undertaking any potential renovations, engaging (not always reliable) builders, and perhaps taking out a bridging loan as extra finance costs of the project. With the costs of holding London properties less and less profitable, this is why many beginners can't see the capital as a place to start of with their limited experience and capital, so they head hours away up north.

In the FREE multimedia course "How to Control a House for a $1 Deposit and No Mortgage Needed", you will discover what most investors don't know, namely take advantage of the London margins and avoid the costs described above.

Because of the high entry costs mentioned previously, traditional buy-to-let investing has become increasingly unrealistic for many would-be investors. As a result, many investors now focus on converting houses or commercial properties into self-contained apartments to resell or rent. Another popular strategy is Rent2Rent— you rent a property (for, say, five years) and then sub-rent rooms to independent tenants who share common living spaces.

However, these strategies come with new layers of regulation and responsibility. Legislation such as the Renters’ Rights Bill, along with strict local-council rules for Houses in Multiple Occupation (HMOs), mean compliance costs and paperwork can mount quickly. For someone just starting out — perhaps juggling a full-time job and trying to gain financial freedom — the process can feel daunting.

To make the numbers work, they buy large houses or commercial buildings, split them into smaller units, apply for multiple rounds of council approvals, and battle through layers of regulation. Then come the maintenance costs, tenant disputes, and the constant wear-and-tear that quietly eats away at profit. By contrast, I vividly recall one investor at a property meeting lamenting in frustration that all his profits for the year had been completely wiped out by emergency repair costs on his rental property. He was a visibly stressed buy-to-let landlord.

Many investors tell me it can take months just to get an offer accepted for the first property — because competition for these properties is fierce. Yet most presenters at live events skip over these real-world challenges. They highlight the success stories, but gloss over the costly mistakes made along the way.

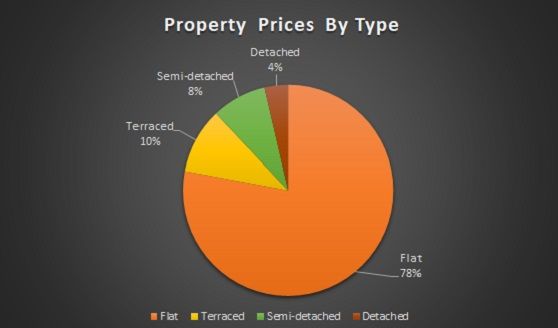

But the market data tells a different story. Properties are taking longer to sell, which means motivated sellers are everywhere. The real opportunity isn’t in fighting over the same limited stock — it’s in stepping outside the crowd to spot deals others overlook, across all categories of property (as shown in the charts).

Over the past year, I attended more than forty investor networking events across London. Again and again, I saw the same pattern: people nod along, agree that London isn’t viable for buy-to-let, then either spend thousands on “education” programs or give up entirely — still stuck in their 9-to-5 financial rut.

But the real opportunity is hiding in plain sight.

A strategy that lets you invest with virtually no competition:

✅ No mortgage required

✅ No mortgage applications

✅ No savings, home equity, or borrowings needed

✅ No stamp duty payable

It was once one of the UK’s most powerful post-crisis approaches — and it still works today.

Yet when I share it, people smile and say, “Interesting…” and then go and do the exact opposite! If you are going to put in the time and effort to attend your local property network meeting, at least be forearmed with an alternative approach that has minimal upfront costs and learning curve compared to what's popular and more complex to learn.

Click on the button below for videos and 23 chapters in audio and PDF format taken from a previous #1 best seller in real estate books, "How to Control a House for a $1 Deposit and No Mortgage Needed".

Other Locations