Why Do Property Investors Network At Live Events In Bournemouth, But Don't Learn How To Get Started With Little Or No Money Down?

Most first-time attendees at property network meetings have little of no money to get started the way presenters explain their strategies — and end up leaving without returning. So, let's get you ready with the right questions to ask!

What's Happening In The Bournemouth Market Today

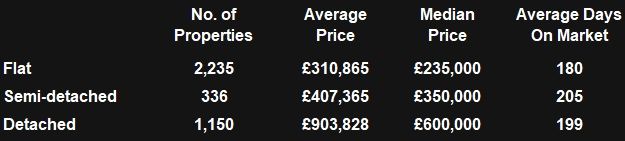

Bournemouth attracts property investors from across the UK, especially from higher-priced southern areas. Prices here are generally higher than some northern cities but remain manageable for certain strategies. In the Bournemouth, Christchurch & Poole (BCP) area, the median house price is around £350,000 (November 2025 provisional), with monthly private rents averaging £1,369, up nearly 6% year-on-year.

Some things to expect:

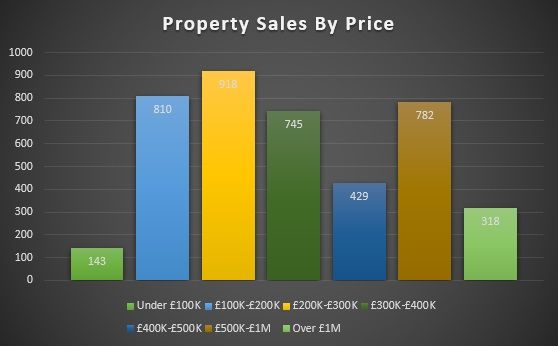

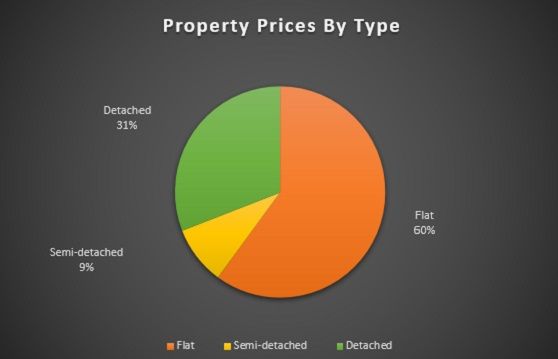

Competition for properties: Popular price ranges are roughly £250,000–£400,000, and well-priced properties tend to eventually move, but expect an average of 195 days for sales subject to contract. Reviewing the chart and data above, you can see that most activity resides in the price brackets between £100,000 and £400,000. These three respective bands make up 59.6% of all sales!

Upfront costs are still significant: Going from the November 2025 median sales prices for semi-detached houses, let's use £350,000 as an example sale price to go by. Therefore, with a 15% discount (£52,500) on a £350,000 property (purchase price £297,500), the upfront cash deposit, Stamp Duty Land Tax (SDLT) and fees will be approximately £94,125 (see summary below).

Additional challenges for non-local investors: With the UK now experiencing landlords leaving the market in greater numbers than those entering, due diligence dictates that you determine what is today's market price, not based entirely on historic rising prices. Also, don't forget to know what to expect for any cost of repairs to bring the property up to value, or improvements to increase its value above what you paid. Note: get familiar with the local economy and the costs of buying, renovating and general running costs.

Tenant management: Shared accommodations or Houses in Multiple Occupation (HMOs) can create more “people problems”, and there is fierce competition among property investors looking to achieve a top return on their investment. Traditional Buy to Let is challenging, trying to keep up with the inflation rates since Covid.

Summary

Market Value: £350,000

Less Discount: £52,500

Purchase Price: £297,500

Cost of Savings:

£74,375 (Your Savings / Existing Equity) + £19,750 (Stamp Duty Land Tax)

Total Cost: £94,125 *

* While yields can be strong, the initial outlay remains a hurdle for many.

Understanding the typical investor approaches beforehand can help you ask meaningful questions and get a clearer picture of how the Bournemouth property market works. You can locate local events by searching "property investor meetings Bournemouth" on Google. I the following section you will find common strategies being discussed that you can research in advance of attending.

When you attend, one crucial question to ask is: “How can I realistically begin investing with little or no money?” Many will suggest deal sourcing — earning a commission by finding properties for others — but that’s not a strategy for building your own portfolio. It may be a better option deal share, where you do the legwork for finaing deals and joint venture with a "hands off" financial partner and split the returns 50-50.

There are other ways to start that don’t require large amounts of cash upfront. Some of these methods gained popularity across the UK after the 2008 financial crisis and remain effective today. My colleague and I have refined these techniques over the past 20 years and packaged them into a free multimedia resource. It shows practical ways to begin property investing with minimal initial funds. You don’t need to review it before attending a meeting, but having this knowledge will help you engage more confidently and understand the bigger picture.

Each of these approaches comes with its own regulatory and financial responsibilities. Legislation such as the Renters’ Rights Act, combined with Bournemouth, Christchurch & Poole (BCP) Council’s HMO licensing requirements and property standards, means compliance costs and administrative work can quickly add up. For new investors — especially those managing a full-time job — navigating these requirements can feel daunting.

Not every seller is motivated, and not every property fits neatly into a profitable strategy. With a deceased estate or divorcing couples, getting everyone to agree on a creative strategy is nay on impossible to get all parties to agree on anything. Even in an active Bournemouth market, many potential deals collapse once financing, refurbishment, or resale timelines are factored and taken into account.

For beginners limited savings — particularly those balancing a full-time job or unsure of where to start — this can be dissuading. Many first-time attendees come to a meeting, see the upfront barriers, and don’t see the point in coming back. Others invest heavily in mentorship programmes (£10K–£25K per year) hoping for shortcuts, but the fundamentals later discover what they are being taught still require capital and credit.

We arrived in the UK in 1994 because I knew the market was rising in the job market, meaning the property would soon follow after years of depression. Preceding the Global Financial Crisis of 2008, the property market was extremely overheated, yet the masses kept driving forward as if the market could only ever go up! And now the same thing is happening all over again, yet 12 months of attending network meetings could not get people to look at how history was repeating itself. When lending tightens — as it is today — investors face higher deposits, stricter criteria, and increased regulation. Yet, these conditions also highlight opportunities that many overlook.

Understanding these points will help you attend your first Bournemouth networking event with realistic expectations and better preparation. Opportunities haven’t vanished — they’ve simply shifted. Some of the most effective strategies are still accessible with minimal upfront investment. One approach allows investors to start with virtually no capital and very little competition:

✅ No mortgage required

✅ No mortgage applications

✅ No savings, home equity, or borrowings needed

✅ No stamp duty payable

This method was widely used across the UK post-2008 and remains effective today. When I shared my 25 years of property knowledge at property meetings, attendees often nodded politely and went back to what the masses were doing (with little understanding of how market cycles work).

If you’re dedicating time to learn and network, it’s worth exploring alternatives that reduce both financial and learning barriers. This strategy is detailed in a free multimedia series, featuring videos, audio, and PDF chapters derived from a former #1 real estate book, “How to Control a House for a $1 Deposit and No Mortgage Needed.”

It’s designed for those who want to understand property control and creative deal structures from home — even if you’re short on capital or just starting your property journey in Bournemouth.

Other Locations