Why Do Property Investors Network At Live Events In Leeds, But Don't Learn How To Get Started With Little Or No Money Down?

Avoid becoming another one-time attendee, only to discover that your education can be costly and the property strategies being taught require savings, borrowing and a decent credit rating...meaning you never return!

What's Happening In The Leeds Market Today

Some things to expect:

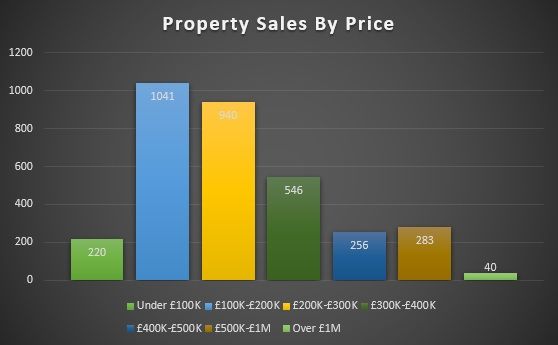

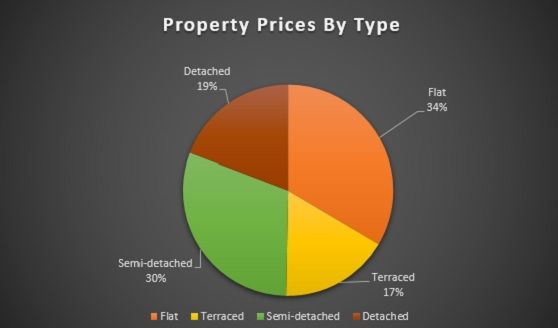

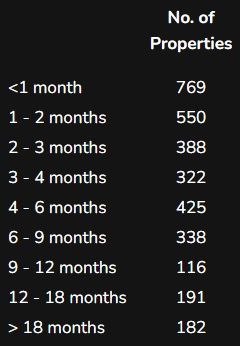

Competition for properties: As per the above chart and data, the most active price range is typically £100,000–£300,000, and these homes tend to sell faster than in southern markets — refer to the above chart and data.

Upfront costs are still significant: Even with a 15% discount (£30,000) on a £200,000 property (purchase price £170,000), the upfront cash deposit, Stamp Duty Land Tax (SDLT) and fees will be over £50,000 (see summary below).

Additional challenges for non-local investors: You’ll need to arrange builders, gas and electrical engineers, and letting agents if you don’t live locally. Without a local presence, you may be spending more than what others do who are familiar with the market.

Tenant management: Shared accommodations or Houses in Multiple Occupation (HMOs) can create more “people problems”, particularly if you’re managing from a distance.

Summary

Market Value: £200,000

Less Discount: £30,000

Purchase Price: £170,000

Cost of Savings:

£42,500 (Your Savings / Existing Equity) + £9,400 (Stamp Duty Land Tax)

Total Cost: £51,900

Even seasoned investors encounter these challenges. For beginners without substantial savings, it’s easy to leave property investor meetings feeling discouraged. Many attendees only come once, mentally confirming what they suspected about the costs and hurdles involved.

Despite the above advanced warnings, you should attend a property investors’ network meeting in your Leeds area to confirm for yourself what are your options. Typing the following into Google, “property investor meetings leeds”, will show you venues nearby. When you attend, consider asking experienced investors this one key question: “How can you realistically get started with little or no money?” The most common answer you will hear is to be a deal sourcer (introducer) working on commission, but that is not a strategy.

However, alternative strategies do exist that were popularised in the UK after the 2008 Global Financial Crisis — and still work today. They are explained in a free multimedia resource that my colleague and I have developed and used over the last 20 years. It explores ways to start property investment with minimal upfront cash. While this isn’t required to attend an event, understanding these approaches can give you context and help you see the bigger picture.

However, these strategies come with new layers of regulation and responsibility. Legislation such as the Renters’ Rights Bill, along with strict local-council rules — for example, Houses in Multiple Occupation (HMOs) — mean compliance costs and paperwork can mount quickly. For someone just starting out — perhaps juggling a full-time job and trying to gain financial freedom — the process can feel daunting.

Over 25 years of developing and introducing creative property strategies in the UK, I’ve seen market cycles repeat themselves. Today, bank lending is tighter, mortgage deposits are higher, interest rates are rising, and regulatory requirements and taxes continue to grow. Many investors are feeling squeezed.

✅ No mortgage required

✅ No mortgage applications

✅ No savings, home equity, or borrowings needed

✅ No stamp duty payable

This was one of the UK’s most widely used post-2008 strategies — and it still works today.

Even when this approach is explained, many people smile politely and then follow the conventional path. Attending your local network meeting is valuable, but going armed with knowledge of alternative methods gives you context. It helps you compare strategies realistically, understand the risks, and decide whether traditional or creative approaches suit your circumstances — all without committing significant capital upfront.

Other Locations