Why Do Property Investors Network At Live Events In Birmingham, But Don't Learn How To Get Started With Little Or No Money Down?

Will you be attending your first property network meeting, only to discover you don’t have enough savings to cover investment costs or expensive mentorship programmes — and end up leaving without returning?

What's Happening In The Birmingham Market Today

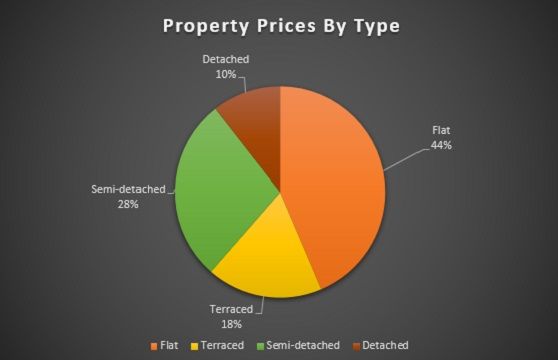

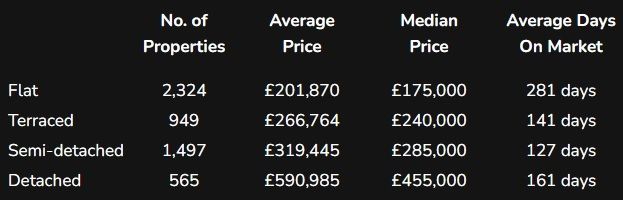

Birmingham’s property market shares some dynamics with other large UK cities, but it has its own characteristics that investors should understand. The above chart and statistics for Birmingham closely align to those of Manchester (click on the Manchester link at the bottom of the page). You would therefore expect much of the dynamics of Greater Birmingham (including West Midlands) and Greater Manchester to be comparable, with populations of 2.9 million and 2.8 million respectively.

Some things to expect:

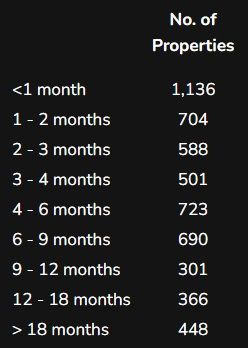

Competition for properties: Reviewing the chart and data above, the biggest cluster of sales activity falls between £100,000 and £300,000, but with average sales days similar to London — possibly due to the aggregation of sales chains from a large population. Noticeably, these three relevant bands between them make up 63.4% of all sales!

Upfront costs are still significant: Going from the July 2025 average sales prices for terraced houses (£216,000) and semi-detached houses (£267,000), let's use £230,000 as an example sale price to go by. Therefore, with a 15% discount (£34,500) on a £230,000 property (purchase price £195,500), the upfront cash deposit, Stamp Duty Land Tax (SDLT) and fees will be approximately £60,000 (see summary below).

Additional challenges for non-local investors: To achieve such a discount, often you will need to calculate for any repairs to bring the property up to value, or improvements to increase its value above what you paid. Without a local presence, you may end up spending more than others who hire locally or have teams in place.

Tenant management: Shared accommodations or Houses in Multiple Occupation (HMOs) can create more “people problems”, particularly if you’re managing from a distance.

Summary

Market Value: £230,000

Less Discount: £34,500

Purchase Price: £195,500

Cost of Savings:

£48,750 (Your Savings / Existing Equity) + £11,185 (Stamp Duty Land Tax)

Total Cost: £59,935 *

* While yields can be strong, the initial outlay remains a hurdle for many.

Knowing these traditional investor approaches before attending a Birmingham event will help you ask informed questions and understand the local market context. You can find venues nearby by searching "property investor meetings Birmingham" on Google.

When you go, ask this one key question: “How can you realistically get started with little or no money?” You’ll likely hear that the only option is deal sourcing — finding properties for others in exchange for a commission. But that’s not a long-term investment strategy.

There are alternative methods that don’t require large savings, and some of them were once popular across the UK after the 2008 financial crisis — and still work today. My colleague and I have adapted and taught these approaches for over 20 years, and we’ve put them together in a free multimedia resource. It explores practical ways to start investing with minimal upfront cash. While you don’t need to study it before attending an event, knowing these approaches will help you ask better questions and see the bigger picture.

From the above chart and data, it’s clear not every seller is motivated, and not every property fits neatly into a profitable strategy. Even in a busy market like Birmingham, many deals fall through once financing, refurbishment, or resale timelines are factored in.

For beginners without significant savings — perhaps juggling a full-time job or unsure where to start — this can feel discouraging. Many newcomers attend a meeting once, realise the upfront barriers, and don’t return. Others invest heavily in mentorship programmes (£10K–£25K per year) hoping for shortcuts, only to discover the fundamentals still require capital and credit.

Over 25 years of developing and teaching property strategies in the UK, I’ve seen cycles repeat. When lending tightens — as it is today — investors face higher deposits, stricter criteria, and increased regulation. Yet, these conditions also highlight opportunities that many overlook.

Understanding these points will help you attend your first Birmingham networking event with realistic expectations and better preparation. Opportunities haven’t vanished — they’ve simply shifted. Some of the most effective strategies are still accessible with minimal upfront investment. One approach allows investors to start with virtually no capital and very little competition:

✅ No mortgage required

✅ No mortgage applications

✅ No savings, home equity, or borrowings needed

✅ No stamp duty payable

This method was widely used across the UK post-2008 and remains effective today. When shared at meetings, attendees often nod politely and return to conventional, more expensive strategies.

If you’re dedicating time to learn and network, it’s worth exploring alternatives that reduce both financial and learning barriers. This strategy is detailed in a free multimedia series, featuring videos, audio, and PDF chapters derived from a former #1 real estate book, “How to Control a House for a $1 Deposit and No Mortgage Needed.”

It’s designed for those who want to understand property control and creative deal structures from home — even if you’re short on capital or just starting your property journey in Birmingham.

Other Locations