Creative vs Conventional Thinking For London Property

Jan 20

/

David Lee

A Tale of Two Investors

Opportunities pass us by every single day. People cannot see them because they are conditioned over time to view the world the same way, often following those around them. Today, we have a tale of two investors, with both of them looking at the same house at the same time, but with completely different mindsets.

Our first investor sees “opportunity” (profit), while the other one just sees “obstacles” (costs). One more thing: this hypothetical house is located in suburban London with no forward chain. Note: conventional investors deem that “London has become unviable” and better opportunities are up north.

Our first investor sees “opportunity” (profit), while the other one just sees “obstacles” (costs). One more thing: this hypothetical house is located in suburban London with no forward chain. Note: conventional investors deem that “London has become unviable” and better opportunities are up north.

🏠 Market Value: £575,000 💰 BMV Cash Offer: £488,750

📖 Story: Owners have mortgage arrears and debts 🆘 They are stressed and need help

Video Presentation

Write your awesome label here.

Video zoom via bottom-right icon above

Creative Investor Tale

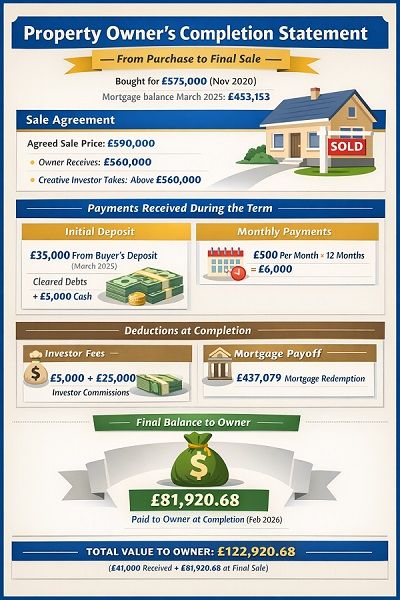

The Creative Investor (CRI) asks if losing £88,250 to pay off £30,000 in debts is a good price to pay. They are stressed and feel trapped to accept the low offer. CRI proposes how they can sell their house for close to market price, get their immediate debts paid off quickly, and have all this happen much faster than with a traditional sale where one in three sales collapse from a broken chain. Being suspicious, because it’s obviously “too good to be true”, they ask, “What’s the catch?” CRI replies, “The catch is if you are flexible with the time frame that the sale takes to complete. But, while you are waiting, you will be receiving monthly instalment payments before it does complete and you get the balance.”

Knowing what CRI knows, he chooses to get the owners £560,000, paid with an upfront deposit, monthly instalments, and at completion with buyers that he markets to for £590,000 on a £40,000 (6.8%) deposit with little cost and no mortgage debt exposure, capital gains or stamp duty payable, CRI has an infinite ROI and can repeat the process.

Knowing what CRI knows, he chooses to get the owners £560,000, paid with an upfront deposit, monthly instalments, and at completion with buyers that he markets to for £590,000 on a £40,000 (6.8%) deposit with little cost and no mortgage debt exposure, capital gains or stamp duty payable, CRI has an infinite ROI and can repeat the process.

1. Seller Scenario

[COPY]+[PASTE] The Text Below Into A New ChatGPT Thread

Please model the following contract of sale into two

separate parts: one for the property owner and one for the creative investor.

A property owner purchased a house in November 2020 for £575,000 using a £57,500 deposit and a capital-and-interest mortgage of £517,500 at 3%, with a fixed monthly payment of £2,454.04. This amount remains intact and unchanged for the duration of the agreement.

After 52 months (March 2025), the outstanding mortgage balance is £453,153.07.

In March 2025, the owner agrees to a delayed sale arrangement with a creative investor and an end buyer. The owner agrees to receive £560,000 out of the transaction, and the creative investor receives anything above the amount with the end buyer.

The creative investor markets that house for £590,000 with an end buyer providing purchase deposit of £40,000, leaving an upfront balance of £550,000.

At the start of the arrangement: From that £40,000 deposit, £35,000 is paid to the seller upfront (used to clear £19,632 of mortgage arrears, £10,000 in unsecured debts and the balance £5,368 cash towards relocation expenses). The investor receives the balance of £5,000 upfront from the buyer’s deposit.

During the 12-month period (March 2025 – February 2026):

– The seller receives £500 per month for 12 months (£6,000 total).

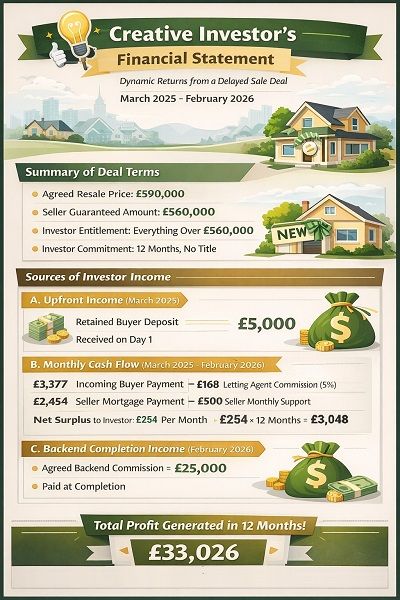

– The investor hires a managing agent to receive the fixed monthly instalment of £3,377.48 for a capital-and-interest schedule of £550,000 at 5.5%.

Monthly payment schedule, paid via the managing agent:

Buyer monthly payment: £3,377.48

Less: £2,454.04 seller's monthly instalment

£500 capital payment to owner

£168.87 agent's commission (5%)

£254.57 creative investor (independent monthly income)

– At final completion (February 2026):

– £25,000 of the sale price is paid to the investor as the backend margin for his management of the sale.

– The seller’s mortgage is redeemed at £437,079.32.

At the time of completion 12 months later, the transaction for the owner is as follows, according to the breakdown of payments received:

Sale price: £590,000

Less: £35,000 deposit received (March 2025)

£5,000 investor part-paid commission (March 2025)

£6,000 12 x £500 monthly payments (March 2025 – February 2026)

£25,000 investor balance-paid commission (February 2026)

£437,079.32 mortgage redemption due (February 2026)

£81,920.68 balance to owner before legal fees (February 2026)

Please produce an owner-focused completion statement that reconciles the money flow during the overall transaction. The output should be clear, educational, and suitable for novice investors to follow.

A property owner purchased a house in November 2020 for £575,000 using a £57,500 deposit and a capital-and-interest mortgage of £517,500 at 3%, with a fixed monthly payment of £2,454.04. This amount remains intact and unchanged for the duration of the agreement.

After 52 months (March 2025), the outstanding mortgage balance is £453,153.07.

In March 2025, the owner agrees to a delayed sale arrangement with a creative investor and an end buyer. The owner agrees to receive £560,000 out of the transaction, and the creative investor receives anything above the amount with the end buyer.

The creative investor markets that house for £590,000 with an end buyer providing purchase deposit of £40,000, leaving an upfront balance of £550,000.

At the start of the arrangement: From that £40,000 deposit, £35,000 is paid to the seller upfront (used to clear £19,632 of mortgage arrears, £10,000 in unsecured debts and the balance £5,368 cash towards relocation expenses). The investor receives the balance of £5,000 upfront from the buyer’s deposit.

During the 12-month period (March 2025 – February 2026):

– The seller receives £500 per month for 12 months (£6,000 total).

– The investor hires a managing agent to receive the fixed monthly instalment of £3,377.48 for a capital-and-interest schedule of £550,000 at 5.5%.

Monthly payment schedule, paid via the managing agent:

Buyer monthly payment: £3,377.48

Less: £2,454.04 seller's monthly instalment

£500 capital payment to owner

£168.87 agent's commission (5%)

£254.57 creative investor (independent monthly income)

– At final completion (February 2026):

– £25,000 of the sale price is paid to the investor as the backend margin for his management of the sale.

– The seller’s mortgage is redeemed at £437,079.32.

At the time of completion 12 months later, the transaction for the owner is as follows, according to the breakdown of payments received:

Sale price: £590,000

Less: £35,000 deposit received (March 2025)

£5,000 investor part-paid commission (March 2025)

£6,000 12 x £500 monthly payments (March 2025 – February 2026)

£25,000 investor balance-paid commission (February 2026)

£437,079.32 mortgage redemption due (February 2026)

£81,920.68 balance to owner before legal fees (February 2026)

Please produce an owner-focused completion statement that reconciles the money flow during the overall transaction. The output should be clear, educational, and suitable for novice investors to follow.

2. Creative Investor Scenario

[COPY]+[PASTE] The Text Below Into The Same ChatGPT Thread

Can you now create a financial statement on behalf of the creative investor from the above data?

Conventional Investor Tale

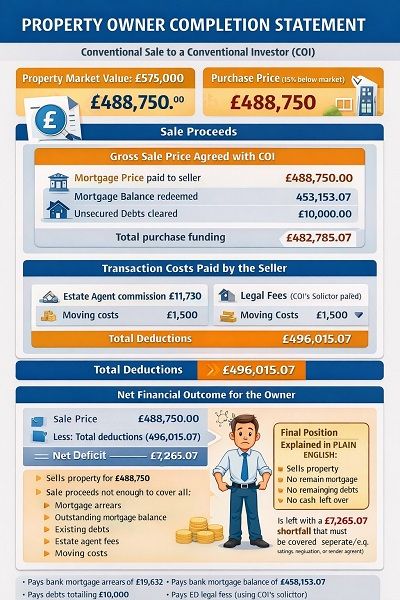

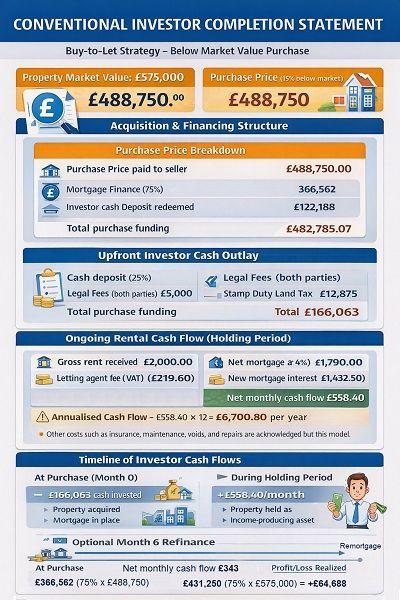

The Conventional Investor (COI) knows only to buy at discount, thus having offered the sellers £488,750 (15% below market value) that will leave them with a total of exit costs adding up to £496,015 (having purchased the property four years earlier). In fact, this leaves the sellers needing to pay £7,265 that they don't have, so it is not going to work for them!

What the sellers don’t know (or don’t really care about) is that COI is in major competition with other potential buyers and someone else could improve the offer to make it work. The COI must have access to funds, as he has to pay out of his own pocket £166,0623, for his mortgage deposit of £122,187.50, Stamp Duty Land Tax of £38,875 and dual legal fees of £5,000. That does not include any potential costs like survey fees, bank arrangement fees and any renovations.

Finally, until any later refinance, a mortgage at 4% interest-only on £366,562.50 results in monthly payments of £1,221.88. Other costs include landlord insurance, lettings agency fees, utility safety checks, general maintenance, and emergency repairs. With a Buy-to-Let rental at £2,000/month, these costs soon add up. Using this simplified model, you can see why our conventional investor is leaving London and heading north instead.

What the sellers don’t know (or don’t really care about) is that COI is in major competition with other potential buyers and someone else could improve the offer to make it work. The COI must have access to funds, as he has to pay out of his own pocket £166,0623, for his mortgage deposit of £122,187.50, Stamp Duty Land Tax of £38,875 and dual legal fees of £5,000. That does not include any potential costs like survey fees, bank arrangement fees and any renovations.

Finally, until any later refinance, a mortgage at 4% interest-only on £366,562.50 results in monthly payments of £1,221.88. Other costs include landlord insurance, lettings agency fees, utility safety checks, general maintenance, and emergency repairs. With a Buy-to-Let rental at £2,000/month, these costs soon add up. Using this simplified model, you can see why our conventional investor is leaving London and heading north instead.

1. Seller Scenario

[COPY]+[PASTE] The Text Below Into A New ChatGPT Thread

A Conventional Investor (COI) offers a seller £488,750 for a

house on the market at £575,000 (15% below market value).

Here is the resulting property owner’s financial position:

– Pays bank mortgage arrears of £19,632

– Pays bank mortgage balance of £453,153.07

– Pays debts totalling £10,000

– Pays £0 legal fees (by using COI’s nominated solicitor)

– Pays estate agent’s commission of £11,730

– Pays moving costs of £1,500.

– Net Result: £488,750 received LESS £496,015.07 payments total = -£7265.07

Please produce an owner-focused completion statement that reconciles the money flow during the transaction. The output should be clear, educational, and suitable for novice investors to follow.

Here is the resulting property owner’s financial position:

– Pays bank mortgage arrears of £19,632

– Pays bank mortgage balance of £453,153.07

– Pays debts totalling £10,000

– Pays £0 legal fees (by using COI’s nominated solicitor)

– Pays estate agent’s commission of £11,730

– Pays moving costs of £1,500.

– Net Result: £488,750 received LESS £496,015.07 payments total = -£7265.07

Please produce an owner-focused completion statement that reconciles the money flow during the transaction. The output should be clear, educational, and suitable for novice investors to follow.

2. Conventional Investor Scenario

[COPY]+[PASTE] The Text Below Into The Same ChatGPT Thread

A Conventional Investor (COI) buys a house on the market at £575,000 for £488,750 (15% below market value).

Here is the resulting COI’s financial position:

Here is the resulting COI’s financial position:

– Borrows £366,562 (75%) from bank to purchase house

– Pays £122,188 (25%) out of personal funds purchase house

– Pays £5,000 for both his legal fees and that of the property owner

– Pays £38,875 to HMRC for stamp duty due

– He rents the house out for £2,000/month

– Pays letting agent £183 + VAT/month (£219.60) in agency fees

– Pays an interest-only monthly mortgage @ 4% of £1,222

– Receives monthly positive cash flow of £558.40

– There are other acknowledged expenses like landlord insurance, repairs, maintenance, voids, but are not included here.

Although not included here, the COI may remortgage after 6 months at the market price of £575,000, realising 75%, being £431,250 and therefore giving him a differential payment of £64,688 (£431,250 - £366,562). However, this will increase his monthly mortgage payments to £1,437.50 and reduce his monthly cash-flow income to £343.90 (£2,000 - £219.60 - £1,437.50).

Please produce an investor-focused completion statement that reconciles the money flow during the transaction. The output should be clear, educational, and suitable for novice investors to follow.

You Make A Profit How?

So, there we have a tale of two investors. On one side our creative investor wonders why the conventional investor is heading north, adding to the competition that currently exists, where he can generate much higher comparative returns with less effort and less competition. As for our conventional investor, he is a die-in-the-heart “buy-and-holder”, irrespective of the market cycle. More than that, he really doesn’t understand what he is walking away from…😊😊😊

Note: This is the worst possible deal for the creative investor and the best for the seller, yet it is still profitable and has little or no financial exposure.

Note: This is the worst possible deal for the creative investor and the best for the seller, yet it is still profitable and has little or no financial exposure.

Join our newsletter!

Thank you!

Write your awesome label here.