Why Vendor Finance Is Ready To Return

Jul 15

/

David Lee

The markets crave certainty, yet today, nothing is certain. Here is just a summary of why: bank failures, migrant crises, authority rule, national debt, BRICS, CBDCs, WW3, inflation, aging society, pandemics, money printing, nuclear threat.

1) History Tells Us

Throughout history, there have been major turning points that have directly impacted the ease of buying and selling houses. The rise and fall of vendor-finance activity in more recent decades stems from how accessible banking finance has been at the time.

Yet, people have short-term memories and adopt the de-facto system without being observant of changes just over the horizon, like the “roaring 20s”, just before the Great Depression, or the early 2000s when, “house prices could only ever go up”, just before the Global Financial Crisis of 2008.

So, here we are in 2024 and it seems like observers are only observant of whether their central banks are going to drop interest rates by a quarter or half a percent after 2 years of regular increases! It’s like , “business as usual”, as the global economic and geopolitical world is on the brink of collapse. Ask yourself, “How can that affect me?”

Yet, people have short-term memories and adopt the de-facto system without being observant of changes just over the horizon, like the “roaring 20s”, just before the Great Depression, or the early 2000s when, “house prices could only ever go up”, just before the Global Financial Crisis of 2008.

So, here we are in 2024 and it seems like observers are only observant of whether their central banks are going to drop interest rates by a quarter or half a percent after 2 years of regular increases! It’s like , “business as usual”, as the global economic and geopolitical world is on the brink of collapse. Ask yourself, “How can that affect me?”

2) Control, Not Buy

This month, we have just released a rewritten a past bestseller on the various practical uses of vendor finance strategies as your portfolio “insurance policy” to today’s uncertainties pertaining to financial health and wellbeing.

Again, if history is any guide to go buy, most people will completely ignore the warning signs until it’s far too late to bail out. They will be highly leveraged with bank credit, have insufficient monthly cash flow being generated from their properties as their tenants feel the financial squeeze themselves, and eventually lose their properties due to mortgage arrears. Just look back to 2008 and what happened to many property investors at that time.

Again, if history is any guide to go buy, most people will completely ignore the warning signs until it’s far too late to bail out. They will be highly leveraged with bank credit, have insufficient monthly cash flow being generated from their properties as their tenants feel the financial squeeze themselves, and eventually lose their properties due to mortgage arrears. Just look back to 2008 and what happened to many property investors at that time.

3) Just Supposing

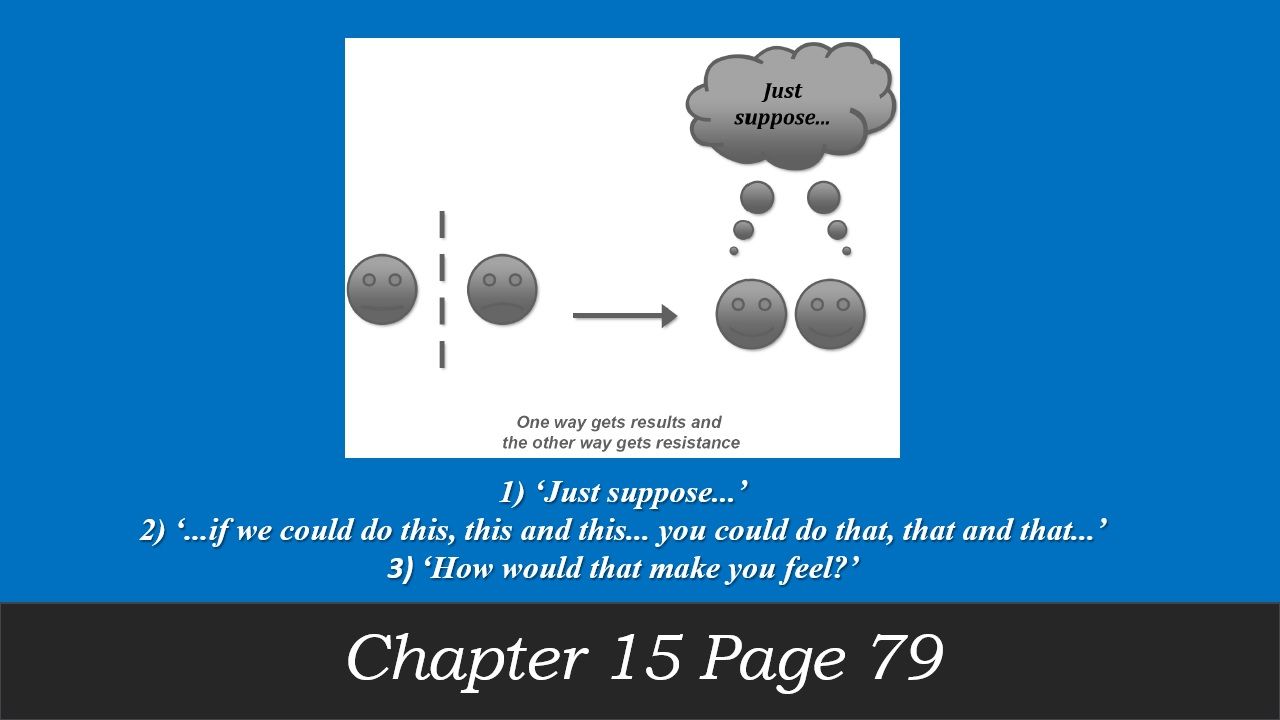

In such an economic upheaval, just suppose how you would be able to profit in these three scenarios without any bank borrowing available? This is what is covered in this month’s conference call.

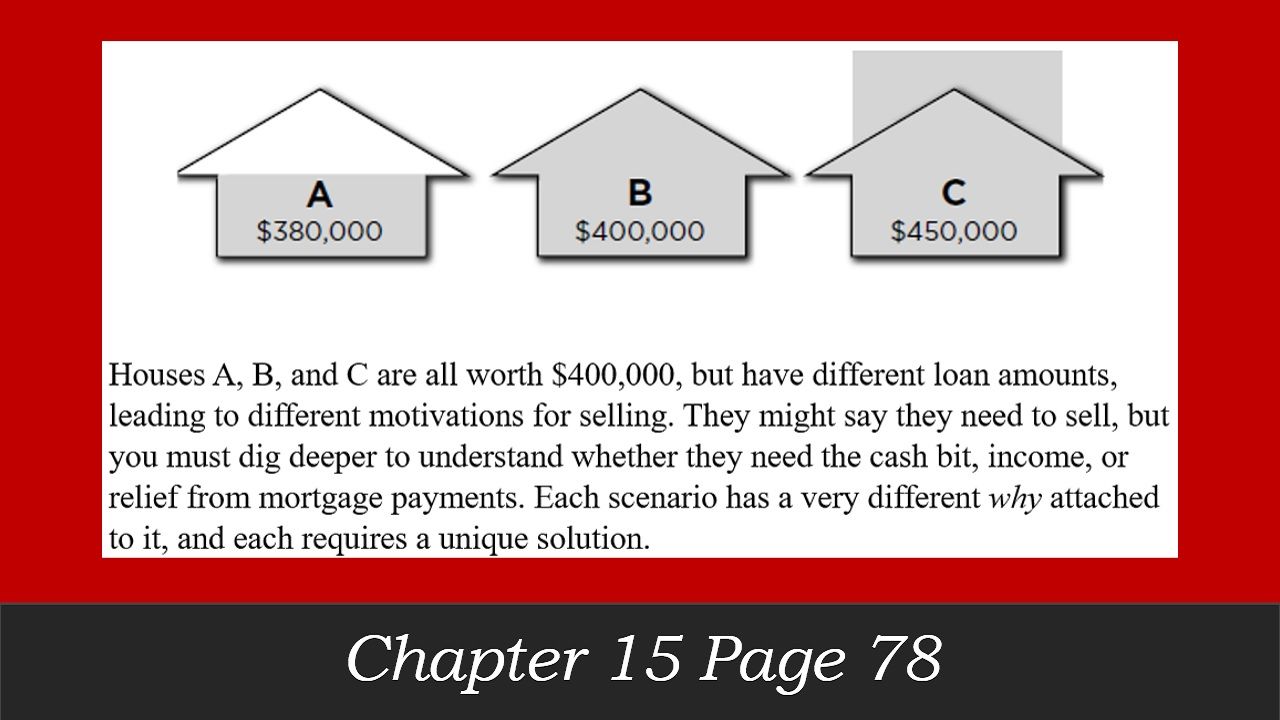

Houses A, B, and C are all worth $400,000, but have different loan amounts, leading to different motivations for selling. They might say they need to sell, but you must dig deeper to understand whether they need the cash bit, income, or relief from mortgage payments. Each scenario has a very different why attached to it, and each requires a unique solution. How will you make a profit?

Houses A, B, and C are all worth $400,000, but have different loan amounts, leading to different motivations for selling. They might say they need to sell, but you must dig deeper to understand whether they need the cash bit, income, or relief from mortgage payments. Each scenario has a very different why attached to it, and each requires a unique solution. How will you make a profit?

Join our newsletter!

Thank you!

Write your awesome label here.