Rethinking Property Investment: The Bigger Picture

Dec 20

/

David Lee

Have you ever stopped to think about why governments seem to support property investment in some ways, yet actively discourage it in others? For example, why is it that, while property investment opportunities like Buy-to-Let are becoming less viable in larger UK cities, local councils are simultaneously encouraging the conversion of commercial properties into residential spaces?

These shifts may look like opportunities, but they also raise important questions about the direction we're heading. As property investors, we may be missing a bigger picture of long-term consequences that could affect us—and future generations—in ways we haven't fully considered.

These shifts may look like opportunities, but they also raise important questions about the direction we're heading. As property investors, we may be missing a bigger picture of long-term consequences that could affect us—and future generations—in ways we haven't fully considered.

A Changing Dream Of Home Ownership

My son is frustrated by the reality his generation faces: working longer and harder to afford far less than his parents or grandparents did. The traditional dream of owning a home, complete with a garden, seems increasingly out of reach for many. Despite the UK’s relatively small homes compared to other Western countries, he grew up with the security of a house and garden.

However, as property prices soar, that dream is becoming harder to realise. We are witnessing a transformation in what it means to be a homeowner in the UK—once a symbol of stability and family, now it’s a shifting concept that’s increasingly influenced by market forces and government policies.

However, as property prices soar, that dream is becoming harder to realise. We are witnessing a transformation in what it means to be a homeowner in the UK—once a symbol of stability and family, now it’s a shifting concept that’s increasingly influenced by market forces and government policies.

What’s Happening to the Idea of the “Castle”?

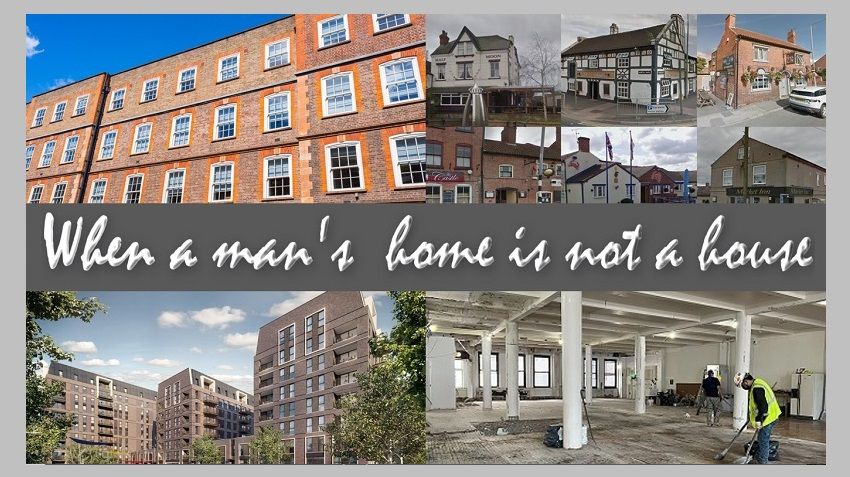

What’s really going on behind the scenes? In recent years, we’ve seen existing homes being divided into smaller units, new developments reaching skyward, and former commercial spaces being transformed into shared living environments. These changes are often sold as progress—but are they really moving us forward? Or are they simply responding to immediate market trends without considering the long-term impact on the way we live?

Governments may claim these shifts are for the greater good, but we should ask ourselves: are these developments truly benefiting society in the long run? Or are they simply a quick fix, driven by short-term economic goals?

Governments may claim these shifts are for the greater good, but we should ask ourselves: are these developments truly benefiting society in the long run? Or are they simply a quick fix, driven by short-term economic goals?

The Future of Housing: A Call for Reflection

There may be short-term financial gains for property investors as the market adapts to new demands, but at what cost? As we face an aging population, a declining birth rate (currently 1.44 per couple in 2023) , and rising pressure for more compact living spaces, we must ask whether today's property trends are part of a larger government-driven agenda.

With the rise of "coffin homes", 15-minute cities, and the push for a cashless society, we’re shaping the future in ways that could have irreversible consequences for our children and grandchildren. Is this truly progress, or are we sacrificing long-term quality of life for short-term profits? As investors, we have an opportunity to step back and think about the lasting effects our decisions might have—not just on our portfolios, but on the broader society.

With the rise of "coffin homes", 15-minute cities, and the push for a cashless society, we’re shaping the future in ways that could have irreversible consequences for our children and grandchildren. Is this truly progress, or are we sacrificing long-term quality of life for short-term profits? As investors, we have an opportunity to step back and think about the lasting effects our decisions might have—not just on our portfolios, but on the broader society.

Join our newsletter!

Thank you!

Write your awesome label here.