Have You Ever Wondered How To Start Property Investing In The UK With Little Money And Still Make A Profit Without Buying Or Borrowing?

By putting ourselves in the shoes of a new investor, we explain how to start property investing with little money—avoiding costs like mortgages, deposits, borrowing, stamp duty or renovations—and still make a good profit. The typical reaction? "Interesting"—before they go back to doing the exact opposite!

FREE 23-PART MULTIMEDIA SERIES JUST FOR SIGNING UP!

Get Started For FREE Today!

Has Anyone Ever Shown You A Property Strategy That Doesn't Need Lots Of Money To Get Started?

If you are just starting out in your property investing journey, perhaps you have gravitated to one of the popular strategies being touted as "the way to go" for building a portfolio. These strategies include Rent2Rent, Rent2SA (serviced accommodation), Comm2Resi (commercial-to-residential conversion), Buy-to-Let, HMOs (Houses of Multiple Occupation), BRR/BRRR (Buy-Refurbish-Rent-Refinance) and Purchase Lease Options.

Yet, despite this wide diversity of strategies, they all have one thing in common: they are heavily dependent on either, 1) being able to borrow money, 2) having ready-made savings, or 3) both! Even the way lease options are promoted requires the investor to be able to cover upfront costs, perhaps get a bridging loan, and later take out bank finance if the property is not being on-sold.

So, where does that leave you? As a new investor with limited funds and working knowledge, how can you realistically get started? What if someone, like us, could introduce you to a proven strategy that was once the most popular way in property when the banks stopped lending after the 2008 Global Financial Crisis! Read on!

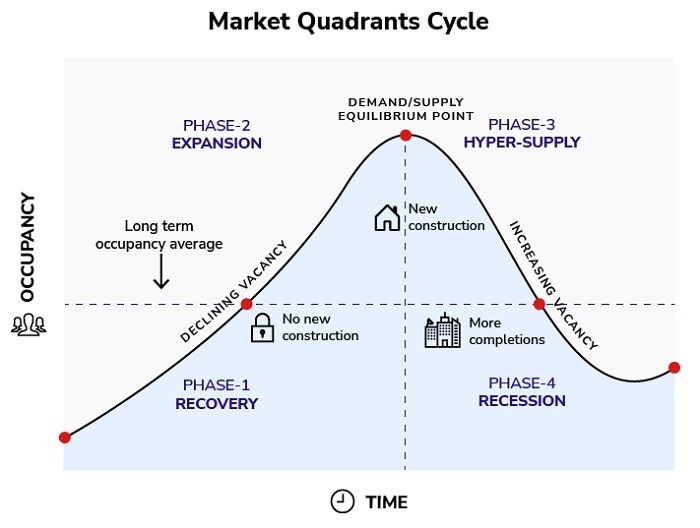

Let's look at the consequences of "groupthink" and how "following the herd" can lead to being blinded from the warning signals over the horizon that the masses can't see. We need to step back and look at the ramifications of what builders, developers and investors can incur when their strategies are responsible for creating an oversupply of a certain type of housing. Have you not noticed in the big cities across the country how the word "house" has been morphed into the word "home", and how that word is really a misnomer for something that we call a "shoebox apartment", while others call it a "coffin apartment"?

History Does Repeat Itself, It's Just The Faces That Change

Sign Up Now For My FREE MultiMedia Course To Change And Rethink Your Property Journey

An Historical Account Behind We Buy Houses Learning

24 Years Ago We Pioneered These Revolutionary Strategies, So Learn From Us Online For A Fraction Of The Price That Our Students Paid At Live Events!